Is Moving to a New Home in Your New Year’s Resolutions?

Are you planning on getting a new home in the New Year? Is moving to a new home part of your New Year’s Resolutions?

Did you know that tax credits can bridge your mortgage gap?

The rules on how much you can borrow for a mortgage changed in April 2014, making the application process more thorough and changing the criteria for lending. This has made it more difficult for many people to borrow as much money when buying a house as they’d like.

The idea behind the changes was to ensure that people only borrowed an amount they could comfortably afford to pay back. Under the previous rules the criteria were not as strictly judged and, therefore, people were borrowing more than they were able to pay back.

But now when applying for a mortgage be prepared for your finances to be scrutinised with a fine-tooth comb and expenditures questioned and possibly factored in to the final calculation of how much you can borrow.

If you have children, any child maintenance or alimony payments will be taken into consideration and may reduce the total mortgage amount. You will also be asked to give details of any changes in circumstances expected – such as if you are going on maternity leave (or paternity leave, as from April 5, 2015), as your income will probably reduce.

Alongside this, you will need to tell the provider you are applying to your projected earnings after your maternity leave – specifically if you are planning to work part-time on return from maternity leave, meaning your earnings will be reduced.

But it’s not all doom and gloom when it comes to applying for mortgages! Some lenders may accept Working and/or Child Tax Credits towards the cost of what you can borrow. Child Benefit may also be included, but it’s wise to check with individual providers.

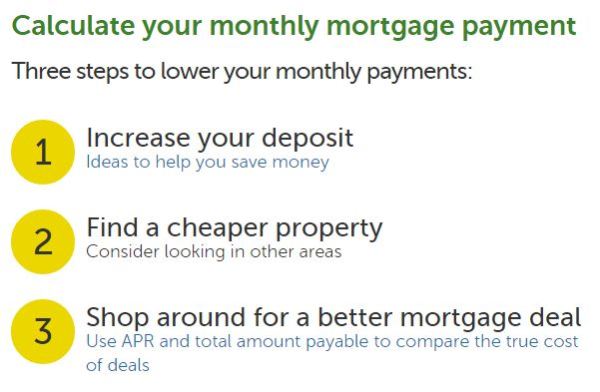

To get an idea of how much you may be able to borrow, have a look at www.moneyadviceservice.org.uk and use their mortgage calculator tool to see what will be taken into consideration in terms of income and outgoings.

You may find that there is a caveat attached to taking benefit payments into consideration against a mortgage in that the lender will need to be assured that they are likely to be paid for the foreseeable future at the current rate or higher.

There is no overarching rule about taking tax credits into account and so you will need to be prepared to discuss the situation in a lot of detail with whichever company you are applying to for a mortgage.

It used to be that a mortgage was calculated on a multiple-income basis – so if your income was £35,000 for example, subject to conditions, the lender would multiply this by, say, a factor of 3.75 and lend £131,250.

But as this was resulting in people not being able to afford their mortgages for a variety of reasons. These new rules tighten up on the process and assess each case on individual incomings and outgoings.

It’s been suggested that prior to applying for a mortgage, cutting down on “extras” (film subscription sites, takeaways, more frivolous things not considered essentials) may help with your application. Companies often scrutinise the past three months’ bank statements as part of the application process so it’s worth trying this in the period leading up to when you want to apply for a new/renewed mortgage.

Guest Post