How to Get a Personal Pension

Financial security is important at any stage of life, but particularly when you are planning for your retirement. With no regular income to rely on from work, it’s essential to have a plan in place to fund the lifestyle you want to enjoy – and that’s where the importance of pensions come into play. There are three main types available – state pension, workplaces pensions and personal pensions – all of which aim to provide you with a nest egg later in life.

While state pensions are given to anyone of retirement age (currently between 62 and 65 for women and 65 for men) who have made at least 30 years of National Insurance payments, workplace pensions are made up of contributions from you, your employer and the government. This sum is then invested in the hope you’ll get a large sum when you retire.

Similarly, with personal pensions your money is invested by a pension provider into a range of investment assets with a view to steadily increasing the total amount of your pension pot over time. Of course, carefully researching which pension provider you should go with is crucial – and not an easy process. You need to be careful of hidden fees and understand exactly what kind of service you’ll be getting.

Here are a few companies that we think are well worth considering.

Nutmeg

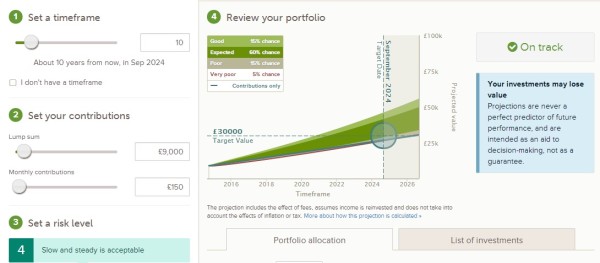

Nutmeg has taken the financial world by storm in recent years. Their innovative and intuitive online service makes pensions and investing in general simple, easy, hassle-free and dare I say it – fun! They build portfolios for each of their many thousands of customers based on their attitude to risk and financial profile. They have a single low annual management fee and you can log in whenever you want to see how all your pension pots are performing. Nutmeg also build and manage stocks and shares ISAs.

Here’s what some of their customers had to say:

- “Nutmeg have taken away the burden of managing my money. I feel safe. With Nutmeg, I have an expert investment team.” — Fergus, chartered accountant

- “They give me absolute trust that they’re on top of my finances — as much as I would be if I was managing it.” — Helen, managing director

- “I don’t see the value in independent financial advisers. I don’t have time to stay on top of the markets. So Nutmeg is the perfect solution.”

Scottish Widows

Scottish Widows plc, is a life, pensions and investment company located in Edinburgh, Scotland and is a subsidiary of Lloyds Banking group. Offering a wide range of products including a professional personal pension service, Scottish Widows have the experience needed to help you find your plan for life and retirement. Their individual pensions cover both pre and post retirement and with options such as the Retirement Account, Stakeholder Pension and Annuities, you won’t be short of financial solutions.

Here’s are some reviews of Scottish Widows and the services they offer:

- “The pre-retirement pack explains annuities well. Good complaints department, good choice of funds with some external funds available. Also apparently interesting “passive” funds.”

- “Scottish Widows provides a very comprehensive package for a stakeholder pension, with good online facilities, a wide fund choice including the option of third-party funds, and a low charging structure.”

- “Scottish Widows has made decent efforts to do more than simply offer a lowest common denominator pension. It offers a reasonable menu of funds, competitive pricing and decent online facilities.”

Legal & General

Legal & General is a British multinational financial services company based in London. They offer a wide range of investment and insurance services and are experts when it comes to providing personal pension plans. They’ll help you provide for your future so you don’t have to rely on the state pension alone and offer numerous options under the personal pension umbrella including a stakeholder pension – a straightforward pension which you can take out online – and a Portfolio Plus Pension which has an impressive array of investment funds to choose from.

Here are some reviews of Legal & General:

- “Overall I think the Legal & General Stakeholder pension is currently one of the better plans on the market. If you’re looking for a straightforward, low cost pension plan you won’t go far wrong with this – just choose your funds carefully.”

- “Legal & General are one of the leading pension providers and it is easy to see why. Well tried and tested. They were recommended and I am glad I followed this up. Very efficient and quick service. Their quote was the best one with the best conditions. All documentation was simple and clear to follow and understand. Since setting this up, all payments have been regular and correct. I feel my pension is in safe hands and when I have made telephone queries, they have been answered quickly and to my satisfaction. There is a pension maze out there, with so many companies bidding to manage your hard earned savings and pension. I can only say from experience and past insurance dealings, that Legal & General are very reliable and trustworthy.”

Do you have a pension?

Guest Post